Cardano

The content of this article

Cardano is a blockchain for dApps and smart contracts – like Ethereum, EOS and more.

What is unique about Cardano, on the other hand, is that the blockchain is made to be safer, faster and more scalable than its “competitors”. In addition, with interoperability, ie. that it can interact with several other blockchains.

The total value of the ADA in December 2020 was USD 1,984,400,532, which means that it was then the eighth largest cryptocurrency.

Its position, among the ten largest currencies, was firmly consolidated in 2020, when its value more than quadrupled during the first 11 months of the year.

The purpose of Cardano is to offer “third generation blockchain” – with solutions to several of the major problems that have arisen with previous blockchains. This such as security, scalability, speed and durability.

Also, the goal is for Cardano to be able to interact with other blockchains and become a kind of “internet of blockchains”. In addition to being the “bridge” between different chains, the blockchain must solve the problem of anonymity, which means that banks are often critical of the handling of cryptocurrencies.

Investing in ADA means a hope that Cardano will become one of the obvious blockchains of the future. A blockchain that “joins” different blockchains into a functioning ecosystem. It is an extremely complex project – as if they reach the goal can be extremely successful.

What is Cardano?

Cardano was founded by Charles Hoskinson, among others, in 2015. The currency of the blockchain, ADA, was launched in the autumn of 2017 and it was then that more and more people opened their eyes to this blockchain.

In short, it is a platform where dApps, smart contracts and payments can be implemented. In part, it can be likened to an operating system on a mobile phone where different apps and functions can then interact.

Security

Cardano is written in the Haskell programming language and for smart contracts the Plutus programming language is used. The advantage of this is that it becomes much easier to create smart contracts without security mistakes. With a programming language that is mathematically and logically structured, any programming errors can be detected early. The increased security takes place through Formal Verification, which means that smart contracts can be security checked before launch.

Smart Contract – For dummies

It is also possible to create smart contracts via the programming language Marlow, which can be explained by being “Plutus for beginners”. It can be used by people who have no knowledge at all in programming. Through a simple program, anyone can create simple smart contracts that can interact with the blockchain.

Ecological sustainability

Proof of Work, which Bitcoin uses, requires large amounts of energy as all the computers in the network “compete” to solve equations and create future blocks. To avoid this, Proof of Stake is used instead. Everyone who holds Cardano can vote on who should be the node (slot leader) and thereby verify transactions and secure the blockchain.

Economic sustainability

Many cryptocurrencies start with an ICO (initial coin offering) when money is drawn into the project. These are used to develop the blockchain based on the goal in its white paper. But what happens when the money runs out? What incentives are there then for improvement?

Cardano has solved this problem with “Treasure”. An extremely small part of the cost of each transaction on the network goes to Treasure: It becomes a fund that is replenished regularly.

However, no person or organization has control over the fund. Instead, it is a smart contract that can distribute parts of the fund provided that the network votes through a proposal received from a developer.

In this way, an economically sustainable development is created for the blockchain with a fund that always has assets and an incentive for developers to submit proposals.

Scalable

A classic problem in blockchains is scalability. How will it handle the increased amount of transactions required in the future? Here, Cardano has solutions with for example both speed and bandwidth.

To solve the problem of speed, Cardano uses Proof of Stake. It is also something that Ethereum has started to move to with Ethereum 2.0 (Dec 2020).

In scalability, the problem of bandwidth is also found. Usually, each node keeps a copy of the entire blockchain. If the blockchain were to receive thousands of transactions per second, it would place very high demands on the bandwidth of those who are nodes, so much that not everyone could meet the demands to be nodes.

The solution is to divide the network into “sub-networks”. This via a technology called RINA (Recursive InterNetwork Architecture). In this case, each node will primarily work within its network but can, if necessary, communicate with other sub-networks.

Interaction with other systems

Today, there are hundreds of cryptocurrencies, in various blockchains. Most people can not interact with each other – for example, it was long impossible to send Bitcoin to Ethereum. However, this has been solved at Ethereum by developing “wrapped” coins.

Cardano wants to be the bridge between different block chains so that different coins can be sent without these first having to be exchanged via an exchange as today.

But they also want to create greater interaction with national currencies. Today, there is a great deal of skepticism about cryptocurrencies among banks and financial institutions. This is mainly because cryptocurrencies are so anonymous.

A goal with Cardano is therefore to create a function that allows voluntary metadata to be used as marking on transactions. Cryptocurrency that comes into an account can, for example, be marked with:

• From Olle Karlsson in Stockholm

• To Nils Olsson

• For payment of a car

By giving the banks a basis and being able to trace the money with certainty, they would, possibly, also be able to handle cryptocurrencies in a simpler way than is the case today.

Unlike Bitcoin, Cardano is not negative about the national currency. Instead, they want to see these different monetary systems interact and exist side by side.

(8 min explaining Cardano)

We use Etoro.com to trade and invest in this cryptocurrency. On Etoro you can buy or take a short position in stocks, indicies, commodities, cryptocurrencies etc in a very easy way both directly in the asset or using CFD:s with or without leverage.

78 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

The future for Cardano

Cardano is still a relatively new blockchain. In 2021, smart contracts are expected to be launched – something that has existed at Ethereum for several years. But it is not only smart contracts that are launched but also more unique functions and services.

• Smart contracts

The basic function at Cardano, smart contracts, will be launched in 2021.

• Convert ERC20 to Cardano

The fact that Cardano is a competitor to Ethereum is clearly evident in the fact that they are expected to launch an opportunity to migrate ERC20 tokens from Ethereum (with expensive transaction fees) to Cardano (low fees). They want to take over one of the features that made Ethereum so popular, ERC20 tokens.

• Stablecoin

Cardano plans to launch its own stablecoin with the goal of becoming more stable and better than MakerDAO.

• Staking

Unlike many other cryptocurrencies, there is no “lock-in period” when staking. In a few seconds you can start or end the staking. This is done by holding the ADA in a Yoroi wallet. An alternative is to run your own staking pool – but most people choose to delegate to an existing pool. The return for staking is about 5% per year and payment is made every five days.

Here, too, Cardano differs from many other cryptocurrencies that use Proof of Stake. In order not to have a few large pools (reduced decentralization), there is a limit to how much a pool can earn. In other words – if there is too much staking, the return will be gradually reduced. This in itself is an incentive for those who delegate to choose another pool.

(Cardano – Get ready for ADA Surge in 2021 / Coin Bureau)

Invest in ADA

You can trade ADA at most major crypto exchanges. Another option is to invest in CFDs, which have ADA as an underlying asset.

CFD – Buy via ex. eToro

Via eToro.com/sv, investments can be made both directly in the asset but also through CFD in about 15 different cryptocurrencies. The advantage of eToro is that the platform is incredibly user-friendly and that no knowledge of cryptocurrencies is required for investment to take place. At least 25USD is traded.

Benefits

• Free deposit via Paypal and bank transfer

• Very user-friendly platform

• Trade directly in the cryptocurrency or via CFD with leverage

Kryptovaluta – Buy via for ex. Binance

If you want to invest directly in the cryptocurrency ADA, purchases can be made via crypto exchanges such as Etoro.com, Binance.com and BitPanda.com.

The advantages of buying ADA via an exchange are that they can be sent to any wallet, exchanged and used as a means of payment. In addition, it is possible to get passive returns just by keeping them in a wallet.

Benefits

• Get a return as a stakeholder

• Can be exchanged for hundreds of other currencies

• Can be used on Cardano Value Development by ADA

The developement of ADA:s valuation

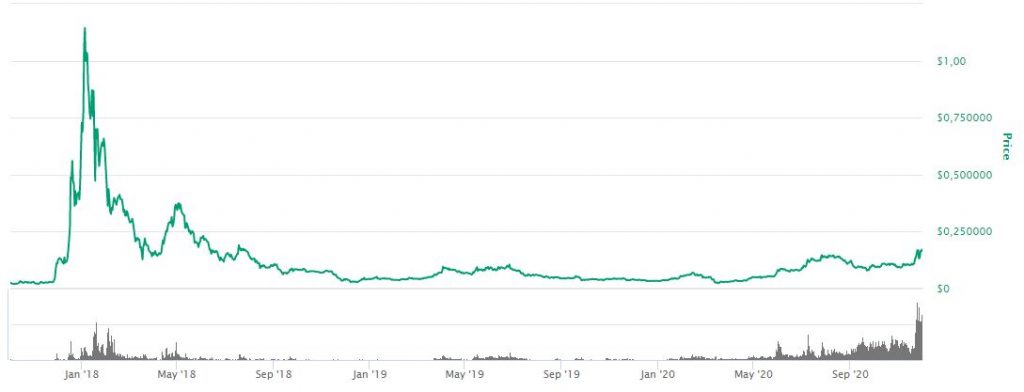

ADA was launched in the autumn of 2017, just a few months before the biggest noise run in crypto history. In just three months, the price went from 0.025 to 1.33. An increase of extreme 5200%. Admittedly, more and more people were opening their eyes to the “third generation blockchain” even then, but above all it was “fomo” throughout the crypto world.

After declines until January 2019, the price was around 0.33, after which a sharp increase has taken place in recent years. This is not least in 2020 when the course has multiplied. The sharp increase in value may be due both to a generally strong value development in the crypto world and to Cardano coming up with news about what would be implemented in their network in 2021

From January 2019 (USD 0.030), the exchange rate increased sharply to December 2020 (USD 0.16). An increase of 430% in two years. Those who believe that Cardano will be the “next Ethereum”, on the other hand, believe that the value is far below what it should be.

What determines the price of ADA?

The price of ADA is determined by supply and demand – like all cryptocurrencies. Can Cardano be as big as Ethereum is today? If they succeed with the goals that are set, they can even be better than Ethereum… Not least if they become “internet of Blockchains”.

Will blockchains and cryptocurrencies become building blocks in the economic system of the future? Will Cardano be the connecting link between these cryptocurrencies and between crypto and fiat? In that case, demand can increase extremely much – and also the price.

The video: One hour interview with Swedish Ivan on tech with the founder of cardano