Bitcoin

The content of this article

Bitcoin is the world’s first, largest and most widely used cryptocurrency. The currency was created in 2008 with the aim of offering an alternative to the monetary system that builds up the world’s national currencies. It is a peer-to-peer currency, which means that no nation, bank or company controls it. Transactions can take place between persons without any interaction by a third party.

The total value of Bitcoin in November 2020 was $ 249,271,540,320. This can be compared with Sweden’s total budget, which in 2020 was approximately 106,900,000,000 USD.

The purpose of Bitcoin is to offer an alternative monetary system – completely free from the influence of states, policies and banks. Instead, its security and stability are maintained through a large network of computers. Each computer has a copy of the log (all transactions) and adds computer power to calculate future blocks to the block chain (future transactions).

With a decentralized currency based on digital code, transactions can take place between private individuals without banks, nations or institutions being able to influence the value, transactions or access to equity.

Is it needed…

In Sweden, where the state has high credibility, Bitcoin has not begun to be implemented as a payment system to any great extent. On the other hand, it is much more common in nations with weak states, high inflation and weak confidence in states / banks. In addition, Bitcoin is accepted as a means of payment in, for example, Japan (often at the forefront of technology) and Switzerland.

Bitcoin is “The Internet of Money”. This means that the currency can have the same great influence over the monetary system that the internet gained over the flow of information. With cryptocurrencies, for example, the 1.7 billion people who do not have access to banking systems can start a wallet and receive / send cryptocurrencies within a minute.

Investing in Bitcoin means investing in the belief that cryptocurrencies will become an obvious part of the world’s economic system and that Bitcoin will remain the largest currency. However, this does not necessarily mean that Bitcoin will become a common means of payment. Many people instead believe that the currency will take the position of gold – but in digital form.

What is Bitcoin?

To more easily explain Bitcoin, and why the currency is being used more and more, this article is based on these three questions:

What problems does Bitcoin solve?

By understanding what money is and how today’s monetary system works, it is also easier to understand why someone invented Bitcoin and why the currency is growing in popularity.

How does Bitcoin work?

By understanding how Bitcoin works (mainly in terms of users), an understanding is given of how the currency is structured and can be used.

How can investment be made in Bitcoin?

By understanding what alternatives there are for investing, the right alternative can be chosen depending on what the goal of the investment is. Is it only to take part in Bitcoin’s possible increase in value or should these coins be used for other purposes (payment, trading, etc.)

We use Etoro.com to trade and invest in this cryptocurrency. On Etoro you can buy or take a short position in stocks, indicies, commodities, cryptocurrencies etc in a very easy way both directly in the asset or using CFD:s with or without leverage.

78 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

What problems does Bitcoin solve?

Bitcoin can be seen as a product of the financial crisis. A crisis that showed clear weaknesses in today’s monetary system. States had to go in with billions to support the banks that had the task of creating and maintaining the economic ecosystem. At the same time, states can “create” money and in this way greatly increase inflation in a country.

So what is the alternative to relying on states and banks to handle the currency correctly? Bitcoin.

First and foremost, it is important to understand that all monetary systems are based on credibility.

Today’s money – Based on credibility

All national currencies are centralized and based on credibility between the currency’s users and their issuers. In the past, gold coin bases were used, which means that a coin had as high a value in the precious metal as the denomination on the coin. In theory, it could be melted down and sold. This way there was a real value regardless of what monetary policy was implemented by the state.

Gold coin base = The currency has a value in the matter / material

Today, this connection does not exist, but those who have the currency simply have to rely on the state that issues the currency.

Depending on how the state acts, the currency will be more or less worthwhile. This is both through inflation within the country and the value of the currency in relation to other currencies. But the basis is that the currency’s users rely on a central player – the currency is centralized.

“When banks have a mandate to create money, or value, they basically control the flow of value in the world – which gives them almost unlimited power”

Today, national currency (fiat) is used without the currency being backed up by any direct value (as an example, gold). A state can create as much money as it wants and still claim that it is worth a certain amount. It’s all about credibility and that banknotes represent a value rather than having a value.

National currency = The currency has a value because the state claims it

Bitcoin works in the same way. It represents a value – without being backed by any physical value.

Bitcoin = The currency has a value that users consider it

Solution 1 – Decentralization

There are few people in Sweden who would claim that the monetary policy pursued ruins the Swedes’ economy. Almost everyone sees the state as stable and credible and with a functioning administration. Sweden has not been the country where Bitcoin has been established the fastest.

Instead, it is in countries where the citizens’ credibility with the state is low that Bitcoin has started to be used more quickly. This is not least in countries such as Venezuela, which at one time was the country in the world that had the most transactions of cryptocurrencies per capita. There, the residents’ credibility with the state is also extremely low. If you do not trust those who issue the currency – then why trust the currency? A currency that also had hyperinflation.

By decentralizing the currency, power is removed from states and banks. Instead, it is the code that completely determines how the currency should act.

Solution 2 – You have the power over your capital

A bank has the right to freeze a person’s capital if the bank suspects money laundering or criminal acts. The capital can therefore be frozen before any court has ruled that the person has acted criminally.

In addition, banks can decide to which recipients money may not be sent from the bank account. In 2020, for example, several banks did not allow their customers to send money to crypto exchanges.

With Bitcoin, it is the user who is responsible for their capital – not the bank. This may also seem “unnecessary” in Sweden, where many people trust the banks and the judiciary. But in other countries, money can not be sent to specific organizations (classified as anti-state), etc. Should you or the state decide where money should be sent?

Solution 3 – To bank the unbanked

With over 1.7 billion people without a bank account, a large proportion are outside the current monetary system. Without a bank account, these are stopped from a large part of the labor market and a number of financial services. With cryptocurrencies, a wallet is created in a few minutes and then the currency can be sent / received. In some countries, this is the main reason why cryptocurrencies have started to be used.

Solution 4 – Transparent

One of the biggest benefits of cryptocurrencies is its transparency. The history of the blockchain is impossible to change and all transactions can always be viewed. It is possible to see from and to which address the transfer took place – but not who has access to these addresses.

A transparent solution that means that the risk of corruption and counterfeiting is reduced or eliminated completely. For example, it is possible to send cryptocurrency directly to people in a village in a developing country without any intermediary. This as long as they have access to the internet.

(Explanation of what Bitcoin is and its benefits)

We use Etoro.com to trade and invest in this cryptocurrency. On Etoro you can buy or take a short position in stocks, indicies, commodities, cryptocurrencies etc in a very easy way both directly in the asset or using CFD:s with or without leverage.

78 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Solution 5 – Fixed level with Bitcoin

There is no limit to how much money can be created through production (coins and banknotes), loans and digital transactions. A state can thus create as much money as it considers itself in need of – even if it can create really bad consequences in the long term.

Through it, states can issue stimulus packages and pay debts to other countries – and create inflation in the market. Inflation will be created and it results in lower purchasing power per krona. Without the residents being able to do anything about it.

With Bitcoin, it is possible to calculate how many Bitcoins are on the market and when all 21,000,000 are broken / produced. It is predetermined in the code and something that can not be affected by monetary policy measures.

Solution 6 – Open-Source

Because Bitcoin is built on open source, it is possible to use the code to create other functions and currencies. This is like an engineer being able to take a drawing and make a new drawing based on the first one.

This is what happened in 2017 when Bitcoin Cash was created. This was done via a so-called “fork”, which in short means that another currency is created. Then it is up to the users to decide if they believe in it and want to invest in the new currency or the original, Bitcoin.

Open-Source also created the transparency that is one of the factors that characterizes Bitcoin.

Bank vs Bitcoin

| Bank | Bitcoin | |

| Transparency for increased safety | No | Yes |

| Centralized (credibility needed) | Yes | No |

| 100% control over your assets/holdings | No (they can be frozen) | Yes |

| Safety of the system | The banks computers | Everyone in the network |

| Risk of hacking | Yes | Yes, but only if more than 50% of the network is taken over |

How does Bitcoin work?

Bitcoin is a currency that is on a blockchain. In other words, blockchain technology and Bitcoin are the first application of using a blockchain. It is important to distinguish between these concepts as all cryptocurrencies today use blockchains and that this technology can also be applied in a number of different industries.

“Blockchains are a revolutionary technology that will be developed more and more. However, this does not automatically mean that the first currency on a blockchain, Bitcoin, will be the currency of the future.“

What is unique about the blockchain? – Solves Double-Spend problems

When a transaction takes place against a centralized party (for example a bank), the bank notes who should have less money in its account (the one who sends) and who should have more (the one who receives). As there is a centralized player, the transactions can take place securely – provided that you trust this player.

If something is to be sent digitally between two people (without any bank as an intermediary), however, a “Double Spend Problem” arises. This is because everything can be digitally copied. Person 1 could copy all his files and then sell them to Person 2 who only gets the copies of it. It is possible to both pay – and still keep the payment.

It is the solution to this problem that makes the blockchain so unique. There have been a number of attempts at digital P2P currencies in the past, but all have fallen on this issue. The solution was an automatically updated ledger that everyone in the network has access to.

- A bank to book on all transactions – No double spending can take place

- Bitcoin transactions are viewed on a log that everyone has access to – No double spending can take place

Blockchain

When a transaction is created, the network’s computers will perform mathematical calculations, after which the transaction is placed in a block which is then added to the current block (block chain). The computers that succeed in solving the calculation are rewarded with Bitcoin – which is called mining.

The computers that are part of the network have dual functions. They both have a copy of the automatically updated logger and add computer power so that mathematical formulas can be calculated and blocks (with transactions) can be created for the block chain. This block also contains information from previous blocks to ensure that no tampering occurs. Every ten minutes a new block is created and new Bitcoins are also created.

The reward was initially 50Btc per block and halved after 21,000 blocks, which corresponds to about 4 years. Until all Bitcoins are manufactured (via mining), automatic inflation is created. Thereafter, rather deflation will be created as supply will decrease over time. This is based on the fact that private keys can be lost, people die, etc.

Simple Example – Manual block chain

This example explains (very simplified) safety with a decentralized ledger.

Example:

In one room sits 10 people. Everyone has pen and paper in front of them. Everyone writes down numbers that represent accounts and then “10 Papercoin” afterwards.

Account 123 = 10 Papercoin

Account 256 = 10 Papercoin

Etc.

One person says he wants to sell his hat for 2 Papercoin and another person agrees to this. In this situation, all people hear what trade is happening – it does not happen anonymously.

Now everyone writes down the transaction on their papers and that 8 people have 10 Papercoin, 1 has 8 and one has 12. Since everyone has exactly the same information, no person can lie and come up with a transaction, create more coins or claim ownership of more. Because all beams are updated automatically and at the same time security is created by consensus.

Now the people are being replaced by computers that do exactly the same thing. They write all the transactions in a book (update the log) and some get a reward for doing this job. In this situation, only the buyer and seller know what the transaction is about – it is done anonymously. The only thing the others can see is a transaction between two accounts. But they do not know who owns the account.

The value is determined by the seller / buyer – based on the credibility that Papercoin will continue to exist in the future. This is in the same way that the value of the Swedish krona rests on people using it and the credibility that the state gives in that the currency will be used in the future.

As the example shows, there are no physical coins – or money. Just a list of who has access to a certain amount of a predetermined asset.

Not coins – but the right to an address

As Bitcoin is completely digital, there are no coins or banknotes. There are also no coins sent between different addresses. Instead, the person owns the private keys required to complete a transaction from a specific BTC address.

In this way, access can be reached anywhere, anytime in the world. As long as there is an internet connection, a wallet can be downloaded and the keys indicated where the possession is displayed (the possession at the address to which the keys go). Many of these wallets (digital wallets) are compatible with several different cryptocurrencies. For example, Bitcoin Cash, Bitcoin and Dash can be handled by the same wallet.

Invest in Bitcoin – The options

Since Bitcoin is the largest cryptocurrency, it is also the currency that is easiest to invest in. Something that can happen via several different ways – depending on what the goal is. What mainly distinguishes the alternatives is whether it is real Bitcoins that are bought or whether it is certificates that follow the value of the cryptocurrency.

Certificate

CFD – Etoro

Via Etoro, investment can be made in Bitcoin through CFD:s (and also directly in the cryptocurrency). CFD:s are contracts that follow the value of the underlying asset. It is possible to trade with leverage and in both buying and selling positions.

The benefits

When trading CFDs, it is very easy to choose between taking buy or sell positions within the same certificate and increase exposure with leverage. With leverage, a smaller capital is required even if a larger position is desired.

78 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Buy real bitcoin

Buying real Bitcoin means that these can be sent to other wallets, trading venues or services. They can be easily exchanged for hundreds of other cryptocurrencies and provide access to any “forks” (divisions of the currency into two currencies).

By card or bank transfer via crypto exchange – Coinbase / Binance

There are several major international crypto exchanges that offer trading in Bitcoin and hundreds of other cryptocurrencies. What is required is first that an account is opened and the ID verified. After that, transfer can be done by card or bank transfer, after which Bitcoin can be purchased. The money can be stored at these exchanges for future purchases

The benefits

The main advantage of buying Bitcoin through, for example, Etoro.com, Coinbase.com or Binance.com is the flexibility. They can be easily exchanged directly for a variety of other currencies or sent to other exchanges and services. A flexible way for you who want to use your Bitcoin, whether it is for payment or within De-fi (Decentralized Finance).

The disadvantages

The downside is that it can take a while to get verified and that it requires a little more knowledge in how cryptocurrencies are handled – compared to buying a certificate. If you have an interest in cryptocurrencies, regardless of level, it is recommended to buy via a large crypto exchange.

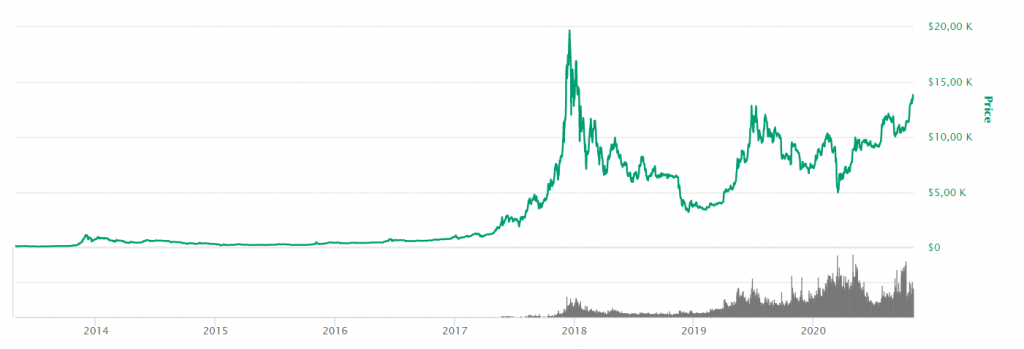

Price development on Bitcoin

During the first years, very few people used Bitcoin and there was no official course. One of the largest sites that follows the value development of cryptocurrencies shows the first exchange rates around 2013. On the fourth of May 2013, a Bitcoin was worth 108 USD – In November 2020, the price was about 13,000 USD.

- 1 Jan 2014 – 772 USD

- 1 Jan 2015 – 300 USD

- 2016 – 430 USD

- 2017 – 1 000 USD

- 2018 – 14 000 USD

- 2019 – 4 000 USD

- 2020 – 7 000 USD

Volatility has been extremely high. Historically, the currency has had several sharp declines but has always recovered with greater strength.

If the peak in 2017 (Jan 2018) is removed, Bitcoin has roughly doubled in value every year since 2016.

After the “crash” in early 2018, and the lowest listing in January 2019, the development has been very positive. Especially for those who have dared to hold on to their Bitcoin even in sharp declines.

What sets the value of Bitcoin?

Bitcoin’s value is based solely on credibility. To rely on the code, the network and that it is a better system than today’s national currency system. Like all cryptocurrencies, supply and demand control the price.

The artery of cryptocurrencies

Bitcoin is today not the cheapest or fastest currency in transactions. For these features, there are several other cryptocurrencies with greater ease of use. Bitcoin is still the most accepted currency among the services that accept cryptocurrencies as a means of payment. It is also the currency to which the largest number of other currencies can be exchanged via crypto exchanges.

Many people see the currency as a digital gold and the “artery” in cryptocurrencies. What function Bitcoin will have in the future, however, remains to be seen.

Is there no value that “backs up” Bitcoin?

No, just as there is no value that backs up the Swedish krona, beyond its credibility with users and international investors.

Official courses via stock exchanges

The courses presented on Bitcoin come from major international crypto exchanges. A couple of years ago, it was not uncommon for the price of Bitcoin to be different at the various exchanges. Today, however, there is an extremely small difference between the different places, which makes it easier to set an exact course.